This is a question I answered more than a quarter century ago in Part I of my book, Money and Debt: A Solution to the Global Crisis. It is a question that gets scant attention from politicians and economists who are willing to speak only about the need for perpetual economic growth and keeping the government debt at “manageable” levels, never asking why government debt is necessary or how it might be eliminated.

When I first undertook to answer this question, the debt crisis was already well underway and global in scope. Since then the situation has become more critical with debt levels reaching astronomical levels.

What I said in 1990 began with this:

The whole world today seems to be awash in a sea of debt which threatens to drown us all. Many Third World countries, despite their huge increases in production for export, are unable to pay even the interest due on their accumulated indebtedness to Western banks and governments. In the U. S., the levels of both public (government) and private debt are increasing at alarming rates. The Federal budget deficits of recent years far exceed anything thought possible just a decade ago. Why is this happening and why is it a problem? In order to understand that, one must first understand some financial facts of life.

Here are the essential points of my argument:

- Almost all of the money in every country is created by commercial banks when they make loans either to the private sector or to governments (by purchasing government bonds, notes, etc.),

- Money is extinguished when loan principal is repaid,

- The interest that banks charge on these loans causes the amount owed to grow as time passes,

- Causing the aggregate amount owed to banks to always exceed the supply of money in circulation,

- Requiring that banks make additional loans to keep the supply of money in circulation from falling behind the amounts needed for existing loans to be “serviced” (repayment of part of the principal plus the interest due) in order to avoid a cascade of defaults and economic depression,

- And that this “debt imperative” that is built into the global money system is the driver of the economic “growth imperative” that results in superfluous economic output and its attendant depletion of physical resources, despoliation of the environment, increasing disparities in income and wealth distribution, and many other problems that plague modern civilization.

- That physical limits to economic output on a finite planet make this money system unsustainable over the long term.

- That there are practical limits to the amount of debt that the private sector is able or willing to incur.

- That chronic government budget deficits are therefore a political expedient that is necessary to keep this flawed system from collapsing as governments assume the role of “borrower of last resort.”

- That politicians are quite willing that governments play this role since it gives them the power to take much more value out of the economy than the revenues available by means of overt taxation.

- That bankers, for their part, by monopolizing the allocation of credit in the economy and charging interest on it, are able to enrich themselves and exercise tremendous power over the political process making a sham of democratic government.

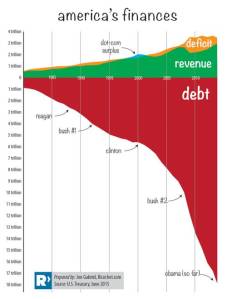

The empirical evidence strongly supports my analysis. You only need to look at charts showing the growth of debt over time to see it growing at an accelerating rate (geometrically), a pattern that reflects the compound interest function that is an inherent feature of our global political money system.

You can read my original 1989 exposition of these points at Money and Debt: a Solution to the Global Crisis, Part I, and their subsequent elaboration in my latest book, The End of Money and the Future of Civilization, https://beyondmoney.net/the-end-of-money-and-the-future-of-civilization/.

# # #

Is it not true? “A Basic Income of say Eight Hundred Euros or equivilant per month for every adult and the extinguishing of all present Social Welfare Benefits, payments etc and extinguish also the present, existing plethora of Income tac, VAT,GST, Customs Duty etc taxation modes ,being replaced by a variable:”Financial Services-Banking Transaction Tax” of as little as Zero Point Zero,Zero two percent( 0.002%) for individuals and Two Percent (2.00%) for all good corporate citizens, coupled- integrated with a “Grand Parent Credit Creation” from Treasury facility could have a more equitable and positive regeneration of any society or any economy and better control over the present “Drunk-out of control corpirates-corporations” Yes?orNo? See for the last week of December 2015

LikeLike

Pingback: 2015 Fall Newsletter | Beyond Money

Dear Mr. Greco

I very much like your assessment. My hope is to change metrics that judge Government performance from GDP to Disposable Energy (how much energy people can buy with their take-home-pay).

GDP is fluffed up as governments borrow and spend debt.

I would like your assessment of the metric Disposable Energy.

http://oilprice.com/Finance/investing-and-trading-reports/Metrics-Replace-GDP-with-Disposable-Energy.html

Also, I would like to see money backed by energy. Life requires energy. Backing currency by energy would encourage wise consumption of energy.

http://oilprice.com/Finance/investing-and-trading-reports/In-Artificial-Markets-Invest-in-Energy-Life-Requires-Energy.html

Thanks

Bill James

LikeLike

Bill, thanks for your comment. Yes, we need better metrics that reflect both well being and economic trends. Hazel Henderson has done a lot of good work in that realm.

Regarding currency “backed” by energy, an adequate discussion on that point would be quite elongated. The first requirement is to define what is meant by “backed,” then to understand the essence of and function of a currency. If by backing you mean, “basis of issue,” any good or service that is in regular demand and available for sale in the market can be a proper basis of issue for a currency, which after all is essentially a credit instrument. Various energy commodities would be included as proper bases of issue, but not exclusively.

A currency also needs to be denominated in some unit to quantify the amount of credit that it represents. That unit could be defined as some amount of energy or commodity or group of commodities. I’ve articulated these points in some detail in my various writings.

LikeLike

Dear Mr Greco,

I used to believe what you’re writing here. And I still think your conclusions are right up until at least point 9. Your argument is not correct though.

The faulty logic is between points 4 and 5. It is simply not true that there is not enough money to pay the loans. There are two faulty assumptions this reasoning is based on:

1. It assumes the bank is outside the system. It is not. Money earned by banks actually flows back into the economy.

2. Not all loans mature at the same point in time. So the same money can basically repay multiple loans one after another.

Please try to follow a spreadsheet I created for you, where I give an example with real numbers:

http://s522077530.online.de/download/JDllt9Ty9Qes/NonMissingInterest.ods

That is really what convinced me back then. I’m convinced now that interest payments are not the problem.

We break the two assumptions in the spreadsheet that lead to the conclusion made above. And those assumptions are not true in the real world. Not all loans mature at the same time. And: The interest payments actually go into paying banks’ employees and owners, who then spend the money to buy goods and services.

What I do in the spreadsheet is, I look at two separate loans, represented by columns F to H and J to L. Because in the real world there is more than one loan out there in parallel. And loans mature at different points in time.

I look at the aggregated state of the borrowers in columns C to D.

Time passes from top to bottom in the spreadsheet. The periods are numbered in column A. I explain in column N what is happening in each period. Columns C to L then show the financial state at the end of each period.

The first loan is taken out in period 1 and paid back in period 12. The second loan is taken out in period 6 and paid back in period 18. I basically assume a 1% interest rate per month to make thinks simpler.

Notice that the interest makes the aggregate amount owed grow as time passes (column D). It’s also true that the amount owed is always bigger than the money in circulation, as you have written.

When we have more than one loan out in parallel, and not all loans mature at the same point in time, then there *is* enough money to pay back each loan at time of maturity.

This is because the money earned by banks is actually spent back into the economy, as represented by a $1 per period flow back from the bank to the aggregate borrowers, after the interest has been earned: The employees paid by the bank and the owner’s profits are actually used to buy stuff.

(I’m not sure I’ve explained myself well enough here. So if you couldn’t follow me right away, I’d be happy to Skype with you and chat about it. 🙂

So that’s really the assumption I made in my spreadsheet: The banks’ employees and owners actually spend all the money that they earn through interest payments on goods and services. That’s a whole different assumption than the two assumptions mentioned above though.

It really means that the system of charging positive interest rates is not at fault here!

My assumption is not completely true in reality either, of course. Part of the earnings are actually saved in reality. And that is the real reason why debt keeps on growing: it’s because people keep saving more and more. Not necessarily most people, but a few people really have a lot. Mind that all government debt is somebody’s savings.

If people keep saving that prevents others from repaying their loans!

So what do we do? What would discourage people from saving more in case companies, governments and other people don’t want to take any more loans?

In a market economy we would usually look at prices to balance supply and demand. And that’s what we could try and do here: We would have to lower interest rates, if necessary well below zero. To do that we’d first have to abolish what is known as the zero lower bound.

Major economists like Mankiw have been suggesting that for years by the way:

So my current theory is that it’s really the still too high interest rates that encourage people to save too much, more than other people (incl. companies and governments) want to take out as loans.

But it’s really not the system of creating money through interest-bearing loans that’s the problem here.

Kind regards,

Martin

LikeLike

Martin,

Thank you for your comment, but I must disagree.

The key question is “what happens to the interest payments made on bank loans in the real world?” I debated this point with Prof. Steve Keen a few years ago after he ran his own simulation using assumptions similar to yours.

As you admit, your “assumption is not completely true in reality either.” You assume that the interest received by banks is spent back into the economy as payments to the bank’s employees and owners. As you put it, “The employees paid by the bank and the owner’s profits are actually used to buy stuff.” That is only true in part, the rest of the bank’s interest income is added to the bank’s capital and used to make new loans or used as as reserves upon which to multiply new lending. That creates a primary deficiency in the amount of money available to repay bank loans, and, as you say, some owners and depositors will not spend all of their dividends and interest, but use part of it to earn more income; that creates a secondary deficiency. Don’t blame savers for the problem, though, they/we are also victims of the interest-based debt-money system. The saving/investment function could be managed in ways that do not involve lending at interest, but as shared equity (see my book, The End of Money and the Future of Civilization).

So, yes, interest earned by banks “flows back into the economy” but only part of it as spending, the other part as new loans.

The fact that “not all loans mature at the same point” is irrelevant to the argument. Money that is outstanding in the economy can be used by non-bank entities to repay their loans to one another, but when money is used to repay principle on loans owed to banks, that money is extinguished, it no longer exists. That money can be used to repay bank loans only once.

So, in order for there to be “enough money to pay back each loan at time of maturity,” the money that was extinguished by repayment must be recreated by banks making new loans.

You also say that “all government debt is somebody’s savings.” Not true. Banks hold huge amounts of government debt (as bonds, bills, notes, etc.). They create the money to do that. Also, the Federal Reserve has been adding government debt to its balance sheet at a prodigious rate. As a central bank, the Fed can write a check against no funds. The Fed buys government bonds by creating new “high powered money” which then ends up in banks as new deposits which enables them to buy even more government debt in some multiple of those new reserves.

So, I still contend that the system of banks creating money through interest-bearing loans IS the fundamental financial and economic problem of our age.

I was not able to open your spreadsheet. It does not look to be a real Excel file. I don’t recognize the .ods file extension.

LikeLike

Dear Mr Greco,

thank you for taking the time to write up a detailed response. 🙂

I think we agree that it’s important what happens to interest payments in the real world. Yes, as I wrote above, the people receiving the interest payments do not spend it all on goods and services. I guess I didn’t make clear that this is actually the second part of my reasoning.

Please try and check out my spreadsheet again for the first part of my reasoning though. (The .ods file is a spreadsheet in the Open Document standard. More recent versions of Excel should be able to read that. In any case, I have converted the file to Microsoft Excel 2003 format now. Just replace the “.ods” in the link above with “.xls”. Please double-click on the cells in column N to read the full explanation text, if necessary.)

What I’m showing in there is that the loans can be repaid. I’ve marked two rows in yellow. You’ll notice they contain the same numbers. This means the process of lending and repaying can go on indefinitely, even if money is created by interest-bearing debt, proofing that this is not the problem. Please let me know if you think I miscalculated somewhere.

Looking at concrete numbers really helped me understand that it is in fact possible to keep repaying all loans, without any need for additional loans or increased loan sums, even with positive interest rates. That’s when I stopped blaming the way our money is created, or the practice of charging interest. What we have to look at is this: yes, the principal amount paid back just extinguishes the loan. This money is gone. The interest paid on the loan, though, was initially created via another loan, so this money is not extinguished by repayment. In my example you could imagine that loan 2 is granted by a different bank. So the interest payment is really not just extinguishing a loan, it’s real money even in the hands of a bank.

In the spreadsheet I’ve been using the assumption that the interest received by banks is spent back into the economy, in order to prove that creating money by lending at interest is not by itself a problem. Because I don’t want to blame the way money is created, when that is not actually the root cause of the problem. If we were to go on believing this is the problem, we would be designing the wrong kind of solutions. We must look at the real reason instead. To summarize so far: I really don’t see a reason why we should end the practice of lending at interest. It is not the reason for ever increasing debts.

My argument now continues by integrating more of reality in my model, namely that banks (their owners and employees) do not spend back every dollar they receive back into the economy. And I now treat this as the real reason that debt is increasing. (This second part is not shown in the spreadsheet any more, but explained below.)

I’m not blaming savers for the problem, either. I’m blaming the system for creating wrong incentives for the savers. During periods of scarcity and economic growth it’s actually great that savers are incentivized by high interest rates, because entrepreneurs actually need the possibility to take out loans and invest. Due to a high time preference at times of scarcity (if you’re hungry, you’d rather have your meal now than later), this incentive is necessary. As society becomes more saturated though, the availability of loans increases as people start to think about the future more, and e.g. increasingly save for old age. Simultaneously the willingness to take out high interest loans decreases with lower scarcity and decreasing average profits in mature economies (see source below).

The reason for increasing debt is that people just want to save more. If you save, you need somebody to owe you money, so somebody must be in debt. If the private sector is not willing to do that, governments will happily replace them (actually not happily at all most of the time, they just don’t see any other options): “borrower of last resort” as you adequately name it.

So why do more people want to save than take out loans? In theory in a market economy this would be balanced by variable prices — interest rates in this case. As we’re approaching the zero lower bound, incentives to save and invest get out of balance though. People are now over-incentivized to save, and under-incentivized to invest. The reason is that central banks effectively establish a minimum height of interest rates at 0%. And that 0% might be still too high to balance supply and demand here.

Yes, I agree, instead of saving money people could just invest in real value instead, like shares, or goods.

The example for shared equity that I could find in your book (on page 225) only seems to make sense if interest rates are higher than 6%, and real financial benefit comes only for interest rates as high as 10 or 12%. Home loans nowadays though are commonly even below 2%! (You write in the book that one would have to look at it in more depth for low interest rates. I have to admit I did not do that. Maybe you can refer me to a different example.)

Average profitability of real world investments is steadily declining. Look for example at the average dividend yield of the S&P 500.

It’s been at about 2% in the last decade, down from about 5% one hundred years earlier. I see no reason why this 150 year old trend should stop any time soon. All the risk involved in real world investments just isn’t worth the 2% profit to most people. So they prefer to save money instead.

So the only way out that I see, in order to balance loan demand and supply, and giving governments even a chance to reduce their debt, is making it less profitable to hold money, effectively allowing significantly negative interest rates in the monetary system. This would lead to a tendency to save less and take out more loans. It would make it easier to finance companies, even those with a low profit rate, thus reducing unemployment. And it would make investments in the real world comparatively more profitable.

By the way, I didn’t see any argument against my reasoning that government debt is somebody’s savings. Yes, the Fed can just create new money to buy government bonds. But that money doesn’t just vanish afterwards. By buying government bonds the Fed gives money to the government. The government doesn’t keep the money: it’s spent on building infrastructure, ensuring social security, financing the military, and more. So it ends up in the hands of companies and real people. A large part of this money is just being saved in the end.

In any case, if the government owes money, there has to be somebody they owe it too. This could be you and me directly, a private investor abroad, or a domestic pension fund. In the end it’s somebody’s investments or savings. I can’t see how it could be any other way.

Best regards,

Martin

LikeLike

Interesting, Tom. Never thought about the distinction between debt and deficit. Having to create money to pay interest on increasing debt will further increase the debt – is that correct? I sense that the debt is but a bookkeeping trick to keep the players playing. Most debts never get paid off, or to do so just increases the overall debt. What would be the consequences if ALL records of debt would disappear both paper and digital? Whose functionality is dependent on debt repayment?

It has always felt stupid and dangerous for the possession of money to enable a person tor entity to make more money, just because of their possession.

Is “wealth” the other side of debt, and equally a phantom? If we remove wealth linked to debt owed, all we have left is material ownership and competency.

Understanding how phenomena “work” doesn’t tell us how to change it.

LikeLike