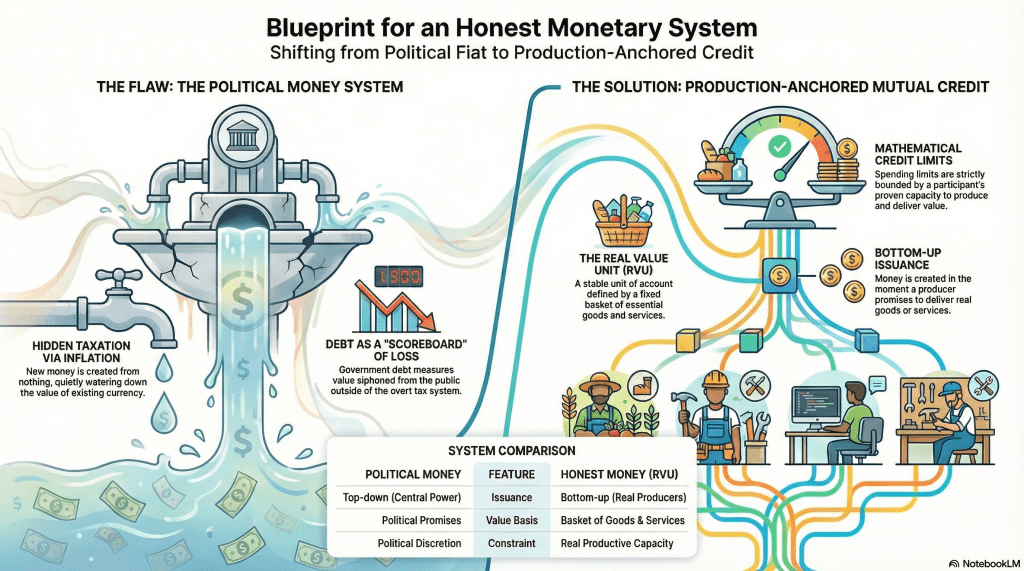

I recently had a conversation with Copilot about designing an honest and effective exchange system that would circumvent the flawed and exploitative fiat money system. I began by saying, “The political money system is structurally flawed, and its eventual collapse is inevitable. That may occur slowly over time via inflation or suddenly with a declared devaluation; in either case the users of the currency suffer losses. Government debt is merely a measure of how much value has been taken from the people outside of the overt tax system. Let’s design an honest monetary system where issuance cannot outrun real output of goods and services.”

That conversation was built around my writings which were fed into Copilot and my responses to Copilot’s replies over several rounds. I then uploaded that entire conversation to Google’s NotebookLM and asked it to generate a video overview that puts it all into a concise non-mathematical description of what I’m aiming to build? The video it produced is truly awesome in explaining, in terms that virtually anyone can understand, how an honest and effective decentralized money system that is anchored to the real economy can be structured and how it operates.

It’s great that AI can produce such clever and professional looking videos (I’m assuming there’s some sort of style option too). But the problem is with your premise.

In fact, almost all money in circulation is produced by banks when they make loans, not the government. Those banks evaluate borrowers’ productive potential too, even like your proposed committees! At least, that’s the theory, and it’s at least in the real world, not hypothetical like your proposal.

Also, I don’t see the connection between the government creating debt – which essentially is spending that goes into the economy, for better or worse results, but that’s a political choice, which, again, theoretically, the public can alter through voting, protesting, forming action groups etc. – and inflation, which is really mainly a supply shortage problem, not government “over-printing” which can’t happen if supply chains can supply the demand*.

Inflation, Milton Friedman notwithstanding, is primarily NOT a monetary phenomenon. It is, however, a way for government to decrease the value of money through its quasi-independent, and bank-supporting, agency, the Central Bank. They do this so that unpayable debts become less onerous and more repayable in nominal terms. It happened after WWII when the debt-to-GDP ratio was last over 100%. It’s happening again today when debt-to-GDP is over 120%, and this helps explain the rise in hard assets like gold lately, since the market knows the effort to weaken the currency is on again. The Central Bank can depreciate the currency through QE, but that is not covered in your video either.

For a serious economic proposal, I think you’ll need to answer some of these questions too.

*I am using the economic definition of demand here, which means people who have the money to buy things to meet their needs and wants. Human demand is different, unlimited, and can include things that are desperately needed, like food and shelter, but which a person doesn’t have money to pay for. They are also left out of your production-only system of barter-credit.

LikeLike

Scott, of course, “almost all money in circulation is produced by banks when they make loans.” I’ve been saying that for decades. What you don’t seem to realize is that the banks and the government are not as separate as you seem to think. Following the Bank of England model, they have been in a collusive arrangement that allows banks to essentially monopolize credit (which is the basis for all legitimate exchange media) and enable central governments to spend almost without limit. That is why sovereign debts keep growing, inflation is persistent, the rich get richer while the middle-class shrinks, and governments become oligarchic.

When government overspends it creates pseudo-money, a legalized form of counterfeit, which has no connection to reciprocity or real value. All of your question are already answered in my books. See especially my ongoing revision and expansion of The End of Money and the Future of Civilization, https://beyondmoney.net/welcome-to-the-new-2024-edition-of-the-end-of-money-and-the-future-of-civilization/.

LikeLike

Thank you for the clarification, and for pointing me to your 4th book, which I have now read the introduction to. I was reacting only to the video, created through NotebookLM, and referred to me by Ellen Brown, whom we both know (me as a Director at the Public Banking Institute, and lately, as AI Chair too).

Your book, of course, provides a far deeper and more sophisticated appreciation of the banking-money system than any 7 minute video filtered through an AI system could do. I tried my own hand at it, producing a pension-fund reform plan at the state and city level to wrest what are essentially collective multi-trillion dollar gifts to Wall Street that barely, if at all after fees, ever reach pensioners:

The issue of bank-government collusion came up in my own research too, and it’s a toss-up, to me at least, which is more dominant in the relationship. Government has the army and the law, but banks have the money and credit-creation ability. The federal government does too, of course, going back to the Constitution’s Art. 1, Sec. 8, clause 5, which allows Congress to “coin Money” where “coin” is used as a verb: to create. The Constitution is silent on banks and certainly on the Central Bank, not created until 1913 with a barely passed law on the eve of Christmas Eve.

I digress. I’ll read the rest of your book, conveniently online now and maybe get back to you with further questions. I think I covered some of same sources in my own book, also out-of-print, but with republishing rights not reverted back to me when the publisher went out of business, “America in Not Broke!” It’s hard to find even on Amazon now. I can send you a free copy if you wish, and would love to hear your thoughts.

LikeLike

Thanks, Scott, for your comments, it seems we have a lot to talk about but let’s do it directly via email or conference call. I watched both your video on New York City’s Finances and the one New York Housing Affordability and commented on both.

I’m quite familiar with the Constitution and the money clause which I have quited in my book. The Federal Reserve was not our first central bank; that was the (First) Bank of the Unuted States which was modeled after the Bank of England and pushed through by Alexander Hamilton and the wealty class in 1791. I have an entire chapter on Chapter 4—Central Banking and the Rise of the Money Power.

LikeLike

If anyone wishes to try their hand at improving on this expository lesson I am happy to work with them. Better graphics? Check! Want to add subtitles in different languages? That would be very helpful. Clarifying statements? Check! You are also welcome to challenge any major assertion contained in the video; I am happy to debate it. Help spread the truth and encourage others to take action.

LikeLike

Dear Thomas

Can you send mit the actual file, I will then translator it into german and publish it on Transition TV. People need to know, what to do. The endgame of the current disorder is our money.

Best

Christoph

>

LikeLike

Okay, Christoph, I’ll send it by email.

LikeLike

On the way via email.

LikeLike

Hi Thomas,

I just watched your video. Wondering if you considered adding in examples of where mutual credit efforts have worked. It would also be helpful to know what factors help those efforts succeed, and what leads to failure of those efforts. Also, can this be done on a small scale with local communities?

Thank you for your continued efforts to help people understand money. I’ve been following your work for many years, and appreciate what you’re doing. My efforts to bring these concepts to my religious community have failed time and time again. I haven’t found a way to effectively communicate how our community could use these concepts to help us thrive. My words fall on deaf ears.

I was hoping this video would offer some new approach that would communicate your ideas in a way that would reach them, but I don’t think it will. I’m not sure what it is that is missing. Maybe the lack f response is simply a sign that people aren’t ready to change. Have you ever looked at motivational interviewing? The idea is to ask questions that help determine if someone is ready to change. Maybe we’re just not there yet.

Best wishes to you,

Julie

https://proton.me/mail/home

LikeLike

Hi Julie, Thank you for your endorsement of my work and for your own efforts to instigate action within your religious community. It’s relatively easy to persuade individuals to change their behavior and adopt something new if they can see immediate benefts from it but getting grousps to organize to deploy a system that moves them away from a lifetime of belief in and reliance from something as pervasive as a system of money, banking, and finance is quite another matter despite numerous small scale successes that prove the concepts and demonstrate the effectiveness of alternatives. Regarding religious communities, they have the advantage of having alredy developed some level of trust among their members but you need to speak their language with Biblical references, for example about the “mark of the beast” and the inability to buy or sell, which looms very close and will be imlemented probably within the next few years. Maybe I wil try to get NotebookLM to create a video overview of those Bible passages, or you might try you own hand at it; it’s relatively easy and there are concise Youtube videos that show you how. I can’t do this all myself.

As for the system design, all of the various components have long since been tested and implemented and demonstrated their success. Like personal computers, they just need to be properly assembled and networked together into what I’ve called a “worldwide web of exchange.”

LikeLike