What You Need to Know About Money. Currency, Credit, and Exchange

Abstract: There remains today, even among economists and “experts,” a general lack of understanding about the essential nature of money, currency and credit, and sound principles of their creation and management. This article provides a point-by-point summary of fundamental concepts and basic principles of exchange, it outlines the systemic defects and destructive nature of the dominant political, central banking, interest-based, debt-money system, and describes the ways in which honest and effective exchange media can be created on a decentralized basis outside of the banking system and in lieu of political money. A wider understanding of these points will lead to the widespread creation of honest exchange mechanisms and the devolution of financial, economic and political power that can change the course of civilization from self-destruction toward peace, justice, freedom and harmonious relationships.

Keywords: credit, currency, honest money, liquidity, monetary myths, monetization, reciprocal exchange, sound principles.

Basic Concepts

The essential nature of money/currency

A currency is a credit instrument, i.e., a promise to deliver valuable goods and/or services.

Basis of Issue

A currency must therefore be issued into circulation on the basis of some value foundation, i.e., goods and/or services that the issuer is ready, willing, and able to sell immediately or in the near future.

Purpose of a currency

The sole purpose of a currency is to facilitate the reciprocal exchange of value in the market. It is not a measure of value, nor is it a savings medium.

Reciprocal Exchange

Reciprocal exchange is the voluntary exchange of one sort of value for another in the market.

Issuance

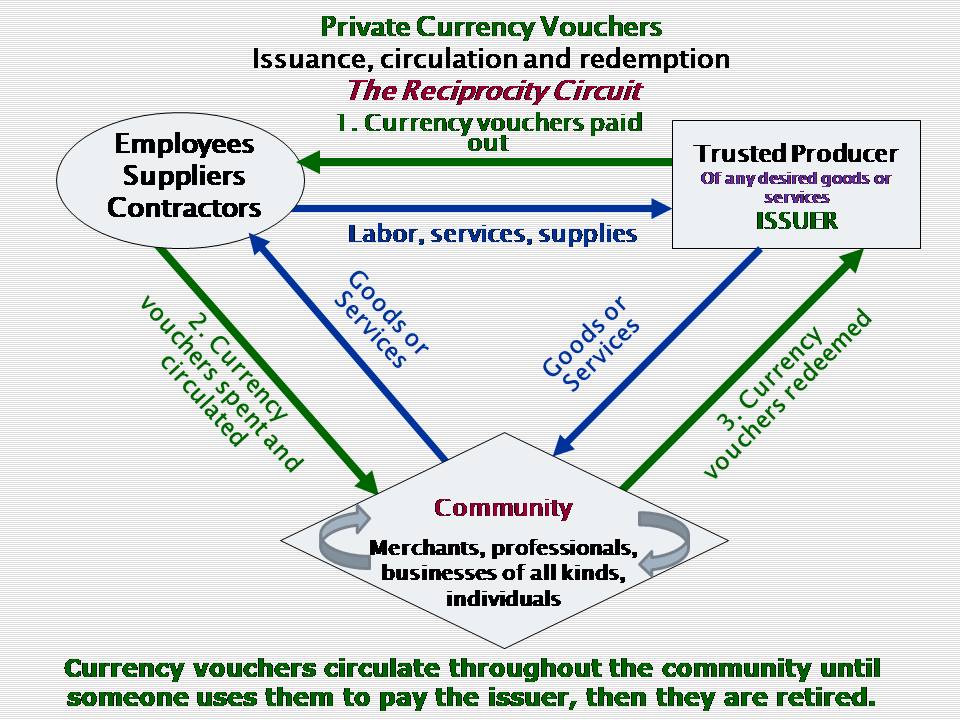

A currency enters into circulation when a provider of value offers it to another seller who accepts it as payment for their own goods or services, i.e., it is spent into circulation, not sold for fiat political money.

Circulation

If it is to serve as a currency, a credit instrument must circulate freely and can change hands many times before eventually returning to the issuer for redemption, not for political money, but for the goods or services that are the issuer’s stock in trade.

Redemption and Extinction

A currency is redeemed and extinguished when the reciprocity circuit has been closed, i.e., when the issuer accepts it back as payment for the goods and/or services that they are prepared to deliver immediately or in the near term.

Liquidity

Liquidity is quite simply the ability to pay, i.e., having a payment medium that is widely accepted.

Monetization

Monetization is the process of converting the value of an illiquid asset into a liquid form, i.e., a form that can be used as a payment medium (money/currency).

Who is qualified to issue a currency?

Since a currency is a promise to deliver value, only producers and providers of real value are qualified to issue a currency.

Fallacious myths about money

- The belief that money must be issued and controlled by governments and/or central banks.

- The belief that banks collectively should have a monopoly on the allocation of credit.

- The belief that interest is a necessary element in money creation and finance.

How is conventional political money issued, and who issues it? - Virtually all political fiat monies are created by banks when they grant loans.

What are the flaws in political money system, and what are their impacts?

- Most bank loans are made on an improper, or inadequate, basis or foundation.

- Government and central bank currencies are no longer defined in terms of any real concrete value unit.

- Thus, most political money is illegitimate and dishonest.

- The interest that banks charge on loans far exceeds the cost of providing the service of monetizing the value of the collateral assets. This causes debts in the aggregate to grow exponentially over time making it impossible for all borrowers to repay what they owe, and making it certain that some must fail.

- The concentration of money power in the hands of ever larger banks, in collusion with central governments, concentrates financial, economic and political power in the hands of an elite “super class” and undermines democratic government.

Assertions and Prescriptions

- To preserve any semblance of social justice, economic equity, individual freedom, and democratic government, power must devolve to people in their various communities.

The only feasible way of achieving that is through the creation of independent and honest mechanisms for exchanging value. - Such honest mechanisms include private currencies issued by providers of real value, and credit clearing associations that allocate credit on a sound basis to producers of real value, and enable them to exchange value without reliance on bank borrowing or the use of political money.

- Such systems are not new; they have long existed and need only to be optimized, standardized, and networked together to provide means of exchange that are locally controlled yet globally useful.

- The future will see the proliferation of entities that organize and enable the allocation of interest-free exchange credit to small- and medium-sized enterprises (SMEs) that are the backbone of resilient and sustainable community economies.

- Standard procedures and protocols for credit allocation and management will emerge that will allow the effective networking of those entities into a global “internet of exchange” using credit that is locally controlled but globally useful.