This is a question I answered more than a quarter century ago in Part I of my book, Money and Debt: A Solution to the Global Crisis. It is a question that gets scant attention from politicians and economists who are willing to speak only about the need for perpetual economic growth and keeping the government debt at “manageable” levels, never asking why government debt is necessary or how it might be eliminated.

When I first undertook to answer this question, the debt crisis was already well underway and global in scope. Since then the situation has become more critical with debt levels reaching astronomical levels.

What I said in 1990 began with this:

The whole world today seems to be awash in a sea of debt which threatens to drown us all. Many Third World countries, despite their huge increases in production for export, are unable to pay even the interest due on their accumulated indebtedness to Western banks and governments. In the U. S., the levels of both public (government) and private debt are increasing at alarming rates. The Federal budget deficits of recent years far exceed anything thought possible just a decade ago. Why is this happening and why is it a problem? In order to understand that, one must first understand some financial facts of life.

Here are the essential points of my argument:

- Almost all of the money in every country is created by commercial banks when they make loans either to the private sector or to governments (by purchasing government bonds, notes, etc.),

- Money is extinguished when loan principal is repaid,

- The interest that banks charge on these loans causes the amount owed to grow as time passes,

- Causing the aggregate amount owed to banks to always exceed the supply of money in circulation,

- Requiring that banks make additional loans to keep the supply of money in circulation from falling behind the amounts needed for existing loans to be “serviced” (repayment of part of the principal plus the interest due) in order to avoid a cascade of defaults and economic depression,

- And that this “debt imperative” that is built into the global money system is the driver of the economic “growth imperative” that results in superfluous economic output and its attendant depletion of physical resources, despoliation of the environment, increasing disparities in income and wealth distribution, and many other problems that plague modern civilization.

- That physical limits to economic output on a finite planet make this money system unsustainable over the long term.

- That there are practical limits to the amount of debt that the private sector is able or willing to incur.

- That chronic government budget deficits are therefore a political expedient that is necessary to keep this flawed system from collapsing as governments assume the role of “borrower of last resort.”

- That politicians are quite willing that governments play this role since it gives them the power to take much more value out of the economy than the revenues available by means of overt taxation.

- That bankers, for their part, by monopolizing the allocation of credit in the economy and charging interest on it, are able to enrich themselves and exercise tremendous power over the political process making a sham of democratic government.

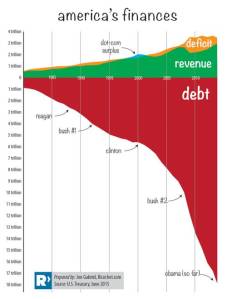

The empirical evidence strongly supports my analysis. You only need to look at charts showing the growth of debt over time to see it growing at an accelerating rate (geometrically), a pattern that reflects the compound interest function that is an inherent feature of our global political money system.

You can read my original 1989 exposition of these points at Money and Debt: a Solution to the Global Crisis, Part I, and their subsequent elaboration in my latest book, The End of Money and the Future of Civilization, https://beyondmoney.net/the-end-of-money-and-the-future-of-civilization/.

# # #