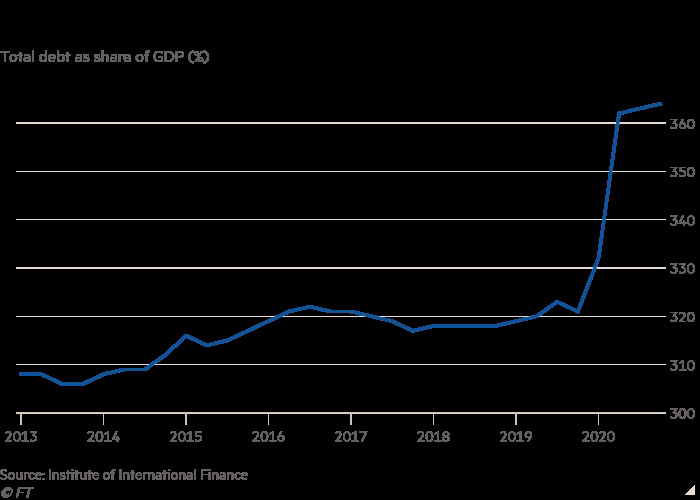

The US dollar is rapidly losing its status as the global “reserve currency.” One after another, nations outside of the western coalition are waking up to the fact that dollars are needed only to pay for imports that come from the United States. In trades with other countries they are choosing to begin paying one another by using their own currencies, as reported in videos like this. They are recognizing that the real resources that they own are much more valuable than the empty promises that are embodied in inflated US dollars or other political currencies. The exploitation of weaker nations by the western powers that has been ongoing for centuries is coming to an end and the emergence of a multi-polar world order is now unstoppable.

The Bretton Woods agreement that established the post-war world financial order in 1944 was based on the promise that US dollars would be redeemed for gold at $35 an ounce. But the continuous debasement of the dollar over the years made that completely unrealistic, and ultimately its impossibility was formally recognized when President Nixon in 1971 “closed the gold window” and announced that the US government was reneging on that commitment. It would no longer give gold for dollars except at the prevailing market price. From that point on the fate of the dollar was sealed; it was just a matter of time. Despite the imposition of a series of extreme financial, economic, political, and military measures by the US and its western allies, time has run out on dollar dominance and the unipolar world order.

The main questions now are, 1) to what further extremes will the western empire resort in its desperate effort to forestall the inevitable political reordering, and 2) what sorts of new monetary and financial arrangements will be established to supplant the old Bretton Woods arrangement?

Regarding the first of these, the past several decades have seen a succession of both covert and overt interferences designed to weaken or neutralize monetary dissidents and potential political and economic rivals. Notable among the former have been Saddam Hussein, who in 2000 began selling Iraqi oil for Euros instead of dollars, and Muammar Gaddafi the Libyan leader who had plans to launch a pan-African currency called the Gold Dinar to free Africa from American domination. As a consequence, both men were murdered and their countries destroyed. Following the NATO invasion of Libya, and the murder of Gaddafi, then Secretary of State, Hillary Clinton, disgustingly and arrogantly boasted, “We came, we saw, he died!”

But nuclear armed Russia and China are not so easy to push around and brought to heel. When their Russian puppet Boris Yeltsin chose Vladimir Putin to succeed him as prime minister, the globalist western oligarchs thought they could continue to rape Russia and exploit its vast resources for their own purposes. But Putin surprised them with his loyalty to “Mother Russia” and his unwillingness to betray the Russian people to the globalists. Whatever we in the west might think about the man, his stance has clearly endeared him to the Russian people.

When the Soviet Union collapsed, the western powers promised not to move NATO farther to the east, but they have reneged on that promise, and one by one have brought the former Soviet republics into the western fold. [Robert F. Kennedy Jr. has elaborated on this point in his recent speech and highlighted the importance of respect for Russia’s legitimate security concerns if ever there is to be peace]. Then, in 2014 the CIA engineered the overthrow of the elected government in Ukraine and replaced it with their own puppet government to further pressure the Russian government to play ball. The perceived existential threat of NATO weapons, even nuclear ones, on their very doorstep, was too much for Russia’s leadership to bear. It should have come as no surprise to anyone that the Russians reacted as they did to counter that threat by launching their “special military operation.” Putin had stated repeatedly that he hoped to negotiate a deal that would respect Russia’s national security interests but the US government has chosen to perpetuate the war in order to weaken Russia and force it to submit. Former nuclear weapons inspector, Scott Ritter, with his military experience and vast knowledge of the region provides a much more nuanced picture of that siltation than the biased sound bites one typically gets from the mainstream media.

Farther to the east, China a major economic, political and military power, has also balked at submitting to a New World Order in which the Western Empire calls all the shots. So now the globalist oligarchs who control the US government see China as a major obstacle to their plan for establishing a trans-human, technocratic utopia under the control of the elite Super Class. Hence, we see continual saber rattling, military and political provocations, and endless prating about the “Chinese threat.”

Regarding a new system of exchange and finance, I expect that we may soon see the emergence of a multilateral system for clearing credits among nations, one that will be more along the lines of the Bancor plan that John Maynard Keynes proposed at Bretton Woods in 1944. Not that Keynes should be the last word on the matter, but he at least proposed a way of preventing trade deficits from becoming perpetual as they are now, by imposing a levy (interest) on positive balances, as well as negative balances, that would seem to eliminate the debt trap. Professor Perry Mehrling provides a brief description of the Bancor plan in this video.

I expect eventually to see the complete depoliticisation of money and the broader application of credit clearing directly among buyers and sellers at the level of individual traders, as they have been doing for decades through the scores of commercial trade exchanges that have been operating around the world. Money is, after all, merely an information system about credits and debits that enables goods and services that are sold to pay for other goods and services that are bought. Further, the settlement of accounts will be done not only through reciprocal exchange, but also through cooperative support and forgiveness of debts, which will bring with it greater fairness and finally a peaceful world. Indeed, there may someday be a world government, but it will not be imposed by force, nor will it be the product of greed and materialistic human minds.

# # #

Addendum: In this excellent article, America Has Just Destroyed a Great Empire, Prof. Michael Hudson offers a history lesson that underlines the points I’ve made in my article.

Here is a small excerpt:

Having endowed the region’s cosmopolitan Temple of Delphi with substantial silver and gold, Croesus asked its Oracle whether he would be successful in the conquest that he had planned. The Pythia priestess answered: “If you go to war against Persia, you will destroy a great empire.”

Croesus therefore set out to attack Persia c. 547 BC. Marching eastward, he attacked Persia’s vassal-state Phrygia. Cyrus mounted a Special Military Operation to drive Croesus back, defeating Croesus’s army, capturing him and taking the opportunity to seize Lydia’s gold to introduce his own Persian gold coinage. So Croesus did indeed destroy a great empire, but it was his own.

Fast-forward to today’s drive by the Biden administration to extend American military power against Russia and, behind it, China. The president asked for advice from today’s analogue to antiquity’s Delphi oracle: the CIA and its allied think tanks. Instead of warning against hubris, they encouraged the neocon dream that attacking Russia and China would consolidate U.S. control of the world economy, achieving the End of History.

But that’s not the way it’s working out. Please read the full article.