2013 – Spring Newsletter

In this issue:

Crowdfunding my 2013 Summer tour

Articles and Projects

- New chapter with Prof. Jem Bendell is now published and online.

- My new article in IJCCR.

Recent events & Presentations

- Money & Life.

- DEBTx prsentation

Crowdfunding my 2013 Summer tour

I’m pleased to announce that I’ve been invited to the EU and UK for a multi-stop tour on the power of currency for people and communities. My itinerary is still evolving but so far I am slated for presentations, workshops and consultations in the Netherlands, Sweden, England, and Greece. I will be hosted for a few days by STRO (Social Trade Organization, then attend the 2nd International Conference on Complementary Currency Systems in the Hague, where I will make a presentation titled Reinventing Money: How Complementary Currencies and Mutual Credit Clearing Can Create a Sustainable, Regenerative Economy, and sit on two panels: The Future of Currencies, and another which will consider the legal and regulatory aspects of complementary currencies.

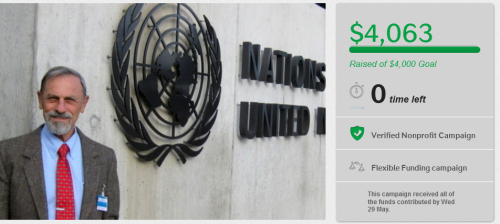

As you’ve probably noticed, travel is becoming increasingly expensive. The CCS organizers will be providing a travel allowance, but it will not be enough to cover even my trans-Atlantic flight, much less living expenses and travel to other stops on my tour. That is why I have launched a Crowdfunding campaign on Indiegogo to help cover the costs of this tour. I need $4,000 to make it to all the places on the tour and cover the costs of food and lodging. I hope you’ll help me make that goal by going here: http://igg.me/at/tomstour/x/31801 and chipping in whatever you can. Please also help me get the word out and share the link with your networks! Thank you!

This is an investment in a sustainable future and, as Swami Beyondananda says: “It’s time to shift our karma out of reverse and get our assets in gear.”

As a quick reminder, on my previous tour last October I gave a total of 15 presentations and workshops to various groups in three different countries. If you’d like a review, you can read my brief report of that tour on this site, here. Your help with this Indiegogo campaign will make all the difference in building on that success and extending this good work to other communities in need! Here’s that link again: http://igg.me/at/tomstour/x/31801. Thanks in advance for your support in getting me to all these exciting engagements and spreading the word about the campaign!

______________________________________

Articles and Projects

Following our participation last October in the International Sustainability Summit at the European Sustainability Academy in Crete, Prof. Jem Bendell and I decided to collaborate on certain projects. One of these was to co-author a chapter for a new book, The Necessary Transition: The Journey towards the Sustainable Enterprise Economy, edited by Malcolm McIntosh. Our chapter titled, Currencies of transition: Transforming money to unleash sustainability, is now online and can be downloaded here. This chapter elaborates on topics I covered in the anthology, The Wealth of the Commons, which I announced previously. You can find that chapter on this site, here.

My newest article, Taking Moneyless Exchange to Scale: Measuring and Maintaining the Health of a Credit Clearing System, has just been published in the International Journal of Community Currency Research (IJCCR). Go here to download it. This article provides some very important guidance for operators and organizers of credit clearing systems like LETS and commercial trade exchanges. Please take the time to give it your attention.

______________________________________

Recent events & Presentations

In March, Katie Teague’s documentary film, Money & Life, in which I make an appearance, premiered in Tucson at the historic Fox Theater. That event also included short presentations by myself and Bernard Lietaer (with Jacqui Dunne). The mayor of Tucson, Jonathan Rothschild, was on hand to introduce us.

In April, I gave a presentation at the DEBTx conference that was held at the University of Michigan Law School. My presentation titled, Debt, Interest, and the Growth Imperative, was delivered remotely from Tucson via Skype, which worked very well. I’m told that the presentations were recorded and will soon be posted to the web, but I don’t yet have the link. It may appear at http://www.law.umich.edu/multimedia/Pages/default.aspx.

______________________________________

Finally, I’d like to remind you that if you sign up to follow me on Twitter or Facebook, you’ll be notified every time I add a post to this site (which isn’t that often, so you won’t be overwhelmed). And please check out our campaign on Indiegogo. Your support will be greatly appreciated and all donations are tax-deductible through NEST, Inc.

Wishing you a pleasant Springtime,

Thomas

We’re on our way! Thanks to you our crowdfunding campaign has exceeded our goal. We are now assured that we will have sufficient funds to carry out our planned work in Europe this summer. Altogether, the tour will span 9 weeks from mid-June to mid-August. The first half is pretty solidly booked with multiple events in the Netherlands, Sweden, the UK and Greece; the second half is a bit more flexible with some room for spontaneous developments.

We’re on our way! Thanks to you our crowdfunding campaign has exceeded our goal. We are now assured that we will have sufficient funds to carry out our planned work in Europe this summer. Altogether, the tour will span 9 weeks from mid-June to mid-August. The first half is pretty solidly booked with multiple events in the Netherlands, Sweden, the UK and Greece; the second half is a bit more flexible with some room for spontaneous developments.