In this issue:

- Breaking Together

- Symbiotic Culture

- Chapter 10, The Third Evolutionary Stage—The Emergence of Credit Clearing

Jem Bendell, former professor and founder of the Initiative for Leadership and Sustainability (IFLAS) at the University of Cumbria (UK) has a highly credentialed background that is impressive by any measure. After a life changing experience, he embarked upon a different life path, delving deeply into diverse disciplines, including the latest climate science, that led to his writing, in 2023, his book, Breaking Together: A freedom-loving response to collapse, in which he summarized his startling conclusions:

“The collapse of modern societies has begun. That is the conclusion of two years of research by the interdisciplinary team behind Breaking Together. How did it come to this? Because monetary systems caused us to harm each other & nature to such an extent it broke the foundations of our societies. So what should we do? This book describes people allowing the full pain of our predicament to liberate them into living more courageously & creatively. They demonstrate we can be breaking together, not apart, in this era of collapse. Jem Bendell argues that reclaiming our freedoms is essential to soften the fall & regenerate the natural world. Escaping the efforts of panicking elites, we can advance an ecolibertarian agenda for both politics & practical action in a broken world.

Jem has since abandoned academia and his “illustrious career of delusion” in favor of a different path that embraces reality and includes practical decentralized actions of adaptation. Breaking Together is available as a free download, but if you would like to get a taste of it before plunging into his 500 page volume, I highly recommend that you listen to this two-part interview in which he quite articulately explains his main ideas, and how we can, by working together, adapt to the inevitable and ongoing collapse of our present version of civilization, and in the process build a better one. Interview Part 1; Part 2.

____________

The work of Richard Flyer puts my own work, and that of Jem Bendell and others within a more comprehensive and foundational context.

In a recent message, Richard Flyer alerts readers to a short video that he posted a couple years ago on his YouTube channel to explain his work of empowerment and societal change. By his own description, “It not only provides solid content about building Symbiotic Cultures and Networks, but it really captures the Spirit, enthusiasm, and hope we need now more than ever—the possibility and reality of Fractal Community Empowerment. It was released more than a year before the book Birthing the Symbiotic Age: An Ancient Blueprint for a New Creation came out on Substack as a weekly series. It shares many of the stories of on-the-ground grassroots movements I have been affiliated with, including San Diego, CA, and Reno, NV, as well as the Sarvodaya Shramadana movement of Sri Lanka – and their relevance today.”

I highly recommend that you take a few minutes to watch his inspiring message, and read the 2-minute synopsis of his book.

____________

Chapter 10, The Third Evolutionary Stage—The Emergence of Credit Clearing

This is the latest chapter to be published of my new 2024 edition of The End of Money and the Future of Civilization. It continues the story begun in the previous chapter of how money has evolved and changed its character over time.

Here is a brief excerpt:

Money has become merely an accounting system, a way of “keeping score” in the economic “game” of give and take. —Thomas H. Greco, Jr.

Let us begin by summarizing the evolution of the various kinds of money that have been used to mediate reciprocal exchange:

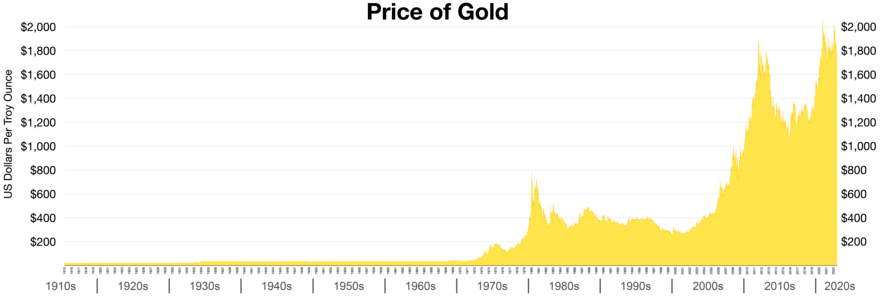

- The circulation of gold and silver coins gave way to paper banknotes that were redeemable for gold or silver coins, which made the notes essentially warehouse receipts for gold on deposit.

- Then, banks began to lend bank notes into circulation based on the pledge of collateral assets (some valuable and others not) other than gold, some of which included government obligations (bonds, notes, etc.).

- But ALL notes were redeemable in gold. This became known as the “fractional reserve banking” system.

- Bank account balances (checkable bank “deposits”) increasingly took the place of paper bank notes, and bank customers began to write checks against their deposits instead of using bank notes to make payments.

- As banks created ever greater amounts of non-bona-fide money based on national government debts and other illegitimate collateral assets, the fiction of gold-backing and redeemability could no longer be supported, and governments reneged on their promise to redeem their currency for gold. This broke the final link between political fiat money and the real economy of valuable goods and services.

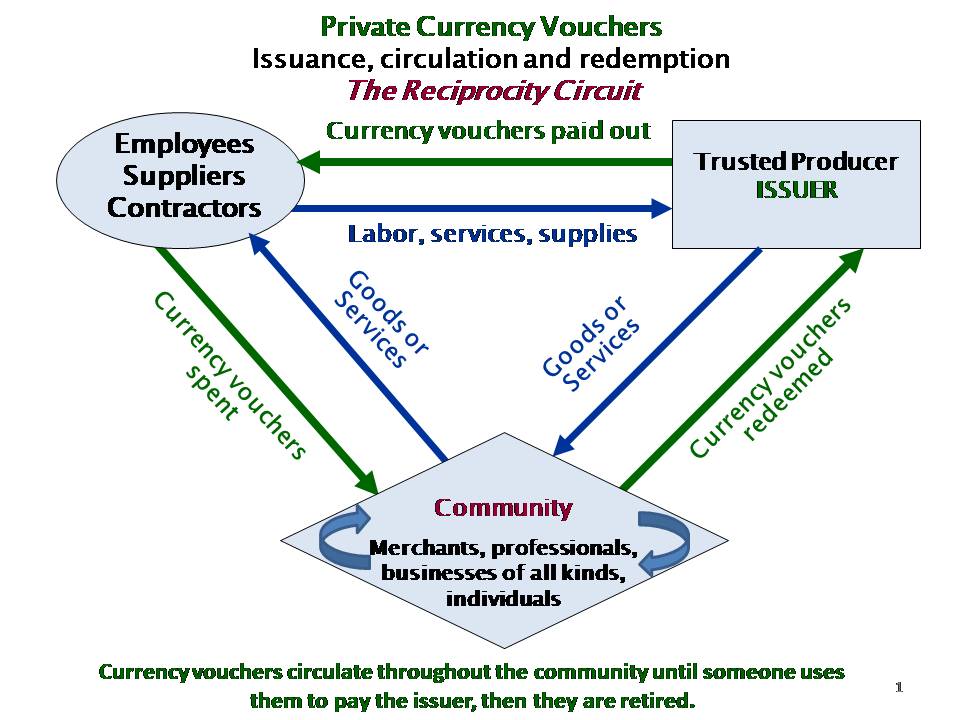

- But, despite that, the emergence of credit clearing to offset credit obligation against credit claims was a major leap forward in facilitating the reciprocal exchange of value.

You can now read or listen to the entire chapter at Future Brightly:

Chapter 10—The Third Evolutionary Stage—The Emergence of Credit Clearing-Text

Chapter 10—The Third Evolutionary Stage—The Emergence of Credit Clearing-Audio narration

____________

The pieces are now all coming together. In what way will you participate in the great adventure?

Thomas