Unlike, government and central bank fiat currencies which promise nothing but their acceptance as tax payments, private currency vouchers promise to be redeemed for real valuable goods and services. If the issuer is trustworthy and can be counted on to honor their pledge of redemption, their currency vouchers can provide traders with an exchange and payment medium that is superior to government and central bank fiat monies. Such honest currencies are neither novel nor odd, but have a long history and are an absolute necessity for the decentralization of economic and political power and the emergence of a peaceful and equitable social order.

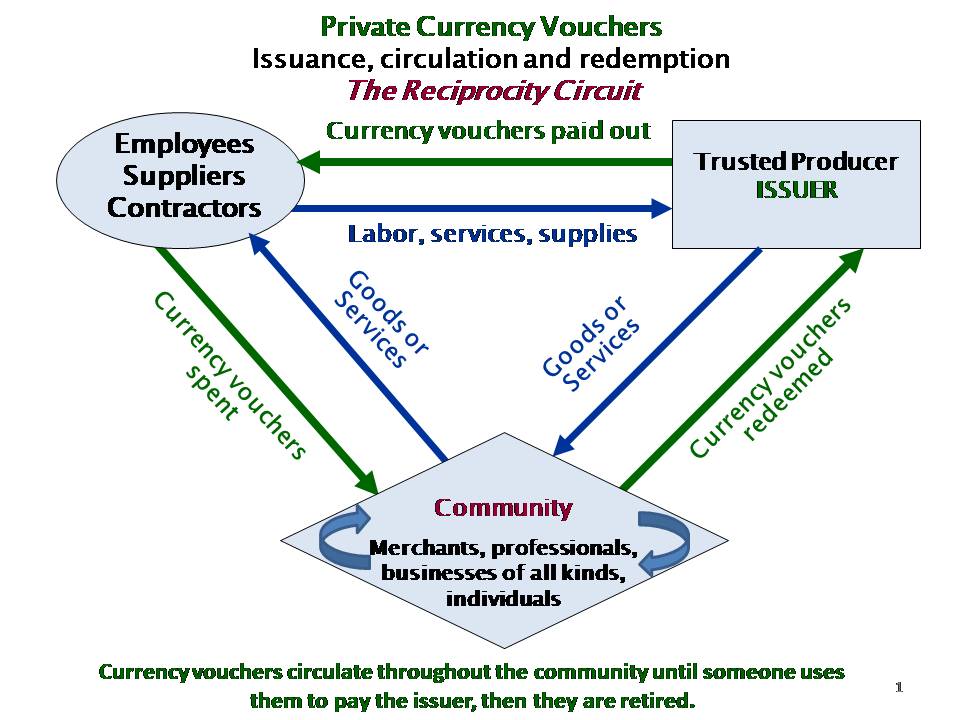

So what sorts of entities can be trusted to keep their promises, how do they put their currencies into circulation, are such currencies legal, have such currencies ever been issued before? In brief, a currency voucher is spent into circulation when the issuer offers it as payment to a supplier, employee or a creditor, who accepts it as such. In the United States and most other “free” countries, private currency vouchers are entirely legal and there are numerous historical instances of their issuance and circulation. These questions and many other details have been fully answered over the years in my various writings and presentations, most of which have been posted or linked on my website, https://beyondmoney.net/. Particularly relevant are my book, The End of Money and the Future of Civilization, as well as my 2021 presentation, Transcending the present political money system–the urgent need and the way to do it, and my 2021 webinar series, Our Money System – What’s Wrong with it and How to Fix it.

A few years ago I wrote up a proposal for a private currency voucher that I call the Solar Dollar which attracted some significant interest. My intention was twofold, one, to provide an independent payment medium for a local community, i.e., a currency that can be created outside of the banking system and thus empower participants in a local economy by compensating for shortages and mal-distribution of government fiat money, and two, to incentivize the shift of energy production, sales and usage toward solar and other renewable sources of electric power. My hope was that some electric utility company somewhere would implement the plan and become a model for others utilities to follow. That, unfortunately, has not yet happened but I am confident that it, or something like it, eventually will. In the meantime, I’ve continued to publicize it, and in 2021 I was invited to give a presentation titled, Solar Dollars–Empowering Communities While Powering Communities With Renewable Energy, for a virtual conference that was sponsored by the Zero Carbon Lab at the University of Hertfordshire (UK). Later that year, under the good auspices of Professor Ljubomir Jankovic, my original white paper was revised and published with the title, Solar Dollars: A Complementary Currency that Incentivizes Renewable Energy, in the academic journal, Frontiers in Built Environment.

Overall, the primary objective of my work has been, and remains, the decentralization of financial, economic, and political power. The most promising strategy for achieving that is the design and deployment of private credit currencies that are spent into circulation by trusted issuers that are ready, willing, and able to redeem their currencies promptly for the real goods and services that are their normal stock in trade. By breaking the credit monopoly that the banking cartel presently holds, and empowering producers and sellers of real value, it then becomes possible to reverse the longstanding trend toward ever greater power and wealth in the hands of the global elite who have captured the machinery of finance, economics, and government.

The Solar Dollar is a special case and example of a private credit currency issued by a trusted producer and provider of real value, but similar objectives could be achieved by companies in other lines of business, for example, by:

- The issuance of local Farm Produce Dollars that would be spent into circulation by a single local farmer or jointly by a cooperating group of local farmers and ranchers, or by

- The issuance of local Shelter Certificates that are spent into circulation by a single local owner of rental property or jointly by a cooperating group of local owners of rental property, or by

- The issuance of Service Certificates by a local provider of some sort of professional or household services, or jointly by a cooperating group of such service providers, or by

- The issuance of currency vouchers by all of the above producers/providers and others who band together to cooperatively issue a sound complementary currency under a common “brand.” Such a currency would provide a means of payment that is not only independent of the banking system but solidly backed by the combined production and distribution capacity of all participating businesses. (Many “community currencies” have been created over the years in many places around the world but virtually all of them are “sold” for government fiat currencies which defeats the main objective of creating a currency that is independent of government and the banking system).

All of these currency vouchers or credits are able to circulate as payment media throughout their local communities to enable trading despite any scarcity or unavailability of official money. There are many historical and contemporary examples of such private credit instruments, so most of what I’m suggesting has already been shown to be workable. The main problem I have observed is getting producers of real value to recognize the power they already have and to exercise it on their own behalf and that of their communities.

In his 1944 book, Private Enterprise Money, E. C. Riegel made that point very clear, saying:

“The stream of political monies from the beginning to the present day runs deep and dirty, yet to suggest that money can spring from any other source is to surprise if not even to dismay. So has tradition dulled men’s senses. No matter how often the state fails to supply a virtuous money system, men rush back to it in desperation and beg it to try again. Indeed, until we learn that the money power resides in us, we must abjectly beg the state to give us an exploitative system because we cannot return to a moneyless civilization. Yet, no matter how often and earnestly the state tries to provide a true money system, it must fail because of an inherent antipathy between the money issuing power and the taxing power. A money issuer must be a seller who bids for money, not a taxer who requisitions it in whole or in part, as politically expedient and without a quid pro quid.” — pp. 25-26.

Political democracy cannot work without economic democracy; and the money power is the franchise of the latter. — p. 35

It is the false concept of political money power that converts citizens into petitioners, and makes government a dispenser of patronage instead of a public servant. This power of patronage utterly destroys the democratic system of government – since the people cannot be both petitioners and rulers.” — pp. 78-79

Throughout my career as a monetary theorist, educator, and advisor, taking up where Riegel and others have left off, I have tried to influence producers, entrepreneurs, and social organizers toward effective action based on sound principles of credit allocation and management. But superstitious myths die hard and old habits are difficult to break. The great majority of people remain in thrall to official currencies. That is what the oligarchs depend upon to keep us in debt and under their control. I have learned to be patient and await the changes in financial, economic, and political conditions that will open people’s minds to adopting self-help and cooperative approaches to getting our needs met, specifically, the need for free and fair exchange of value in the marketplace.

Surely, the day will come, and is rapidly approaching, when the failures and demands of the dominant global central banking, political, interest-based, debt-money regime will become so clearly evident and abysmal that the only peaceful option will be for we-the-people to implement our own systems of exchange and finance grounded in our own initiative and judgment in allocating credit based on productive capacity and trustworthiness.

_______________________

Pingback: Newsletter, June 2023 — The Emerging New Civilization | Beyond Money

Money is at the branch, not at the core, of the problem.

What is at the core?

https://saidit.net/s/WritingsOnTheWall/comments/a8su/what_is_the_core_of_the_problem/

Mindset seals fate:

https://saidit.net/s/WritingsOnTheWall/comments/adx4/mindset_seals_fate/

Thus, the constant distraction – to focus & minds usurped.

Usury-money is one of the means for actual usurpation to be effected once the mind has been subjugated.

https://saidit.net/s/WritingsOnTheWall/comments/abjc/unshackle_your_mind_from_elitedom_for_elitefreedom/

Usury money, no doubt, a key and insidious means of usurpation, but it is not at the root.

To win, we must normalize our agenda – Usurper-free Dom:

https://saidit.net/s/WritingsOnTheWall/comments/adha/what_are_you_willing_to_fight_for/

https://saidit.net/s/WritingsOnTheWall/comments/aeqp/to_fight_evil/

A paradigm change,

followed by a value change,

leading to a reality change.

LikeLike

Reblogged this on Calculus of Decay .

LikeLike

I read your book “The End of Money…” shortly after its release in 2009. I was living on Gabriola island in BC, and had the pleasure of meeting Mr. Paul Grignon whose animations “Money as Debt” and “The Essence of Money” I commend to anyone not already familiar with them.

I always felt that there was something intrinsically ‘wrong’ with money but I couldn’t put my finger on it. Your book, along with Paul Grignon’s videos, and—of course—E.C. Riegel’s works (which you led me to) helped me enormously.

I tried to create a ‘simulation’ of the system you describe on the web but ran into technical difficulties (perhaps finding the true limits of my understanding) when I attempted to calculate the real time value of a given producer’s token, relative to the amount that were already in circulation and the demand for the producer’s goods or services. For any such system to work well, I think there needs to be additional provision to encourage tokens to find their way back to their issuer as quickly and expediently as possible.

Now I am trying to get my ageing head around blockchain and other decentralised systems—as these seem like our best bet for creating a truly global, extensible system—one that can grow organically. If you are aware of any promising technologies (Todd Boyle mentioned ‘Venmo’) I would appreciate any suggestions.

In any case, many thanks for all your work. I thought that you would like to know that you have enlightened one soul, at the very least!

LikeLike

Thank you Dan for your comment.

Yes, I also have been recommending Paul Grignon’s animated videos “Money as Debt,” and especially “The Essence of Money” which briefly and clearly describes how producers of real value are able to spend their own currency vouchers into circulation and thus provide the entire community with payment media that can circulate alongside, and instead of, government and central bank fiat money. Furthermore, they bypass the banks’ monopoly on the allocation of credit and save people the cost of borrowing money at interest.

I’d like to know how you tried to simulate the system I’ve described and what specific problems you ran into. You might first read my article, Taking Moneyless Exchange to Scale: Measuring and Maintaining the Health of a Credit Clearing System.

The focus of this article is on credit clearing as a local moneyless exchange option, and deals specifically with the proper allocation of credit within credit clearing exchanges. It was published in the International Journal of Community Currency Research (IJCCR) in April, 2013. It’s listed on this site under Recent Articles and you can find it at https://ijccr.net/2013/04/30/taking-moneyless-exchange-to-scale/.

LikeLike

By their decisions, in the aggregate, to whom they’ve allocated credit, the member banks of the major powers’ central banks have written their decisions upon the physical infrastructure of the world (called, “capital investment”). Moreover their decisions of what to finance, and to whom the money is given, have created the political economy we live in today.

LikeLike

If a generalized platform were available where businesses could create their own currencies (like coupons, or the gift cards they issue), AND, the platform supported user accounts, AND, the platform supported transactions among users and businesses via the Card Services system like other debit cards, THEN everybody would be winners, especially businesses who would reap seignorage gains, and gains from unredeemed units. I would expect a liquid marketplace would emerge where users could convert from one business’ unit to another.

But this has to be electronic and convenient. The newer models like venmo offer new possibilities. But you have the same problem as banks– hackers, thefts, errors, and labor costs to adjudicate repudiability. If not for that! Banks would be a lot cheaper and wouldn’t require today’s massive subsidies.

LikeLike

Right you are about the advantages of the platform and the problems of hackers, thefts, errors, and labor costs to adjudicate repudiability, but it would still be much better than depending on dollars that banks create by making “loans” at interest. Why? Because banks charge interest far in excess of the cost of operations and because they often allocate credit to “borrowers” who have not real value to offer, especially the central government who never pays back but just keeps adding to the amount they “borrow,” thus debasing the value of the dollar.

LikeLiked by 1 person