Dave Gardner is director of the upcoming documentary GrowthBusters. Here is his recent article that appears on the website of the Center for the Advancement of the Steady State Economy (CASSE).

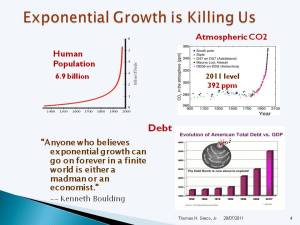

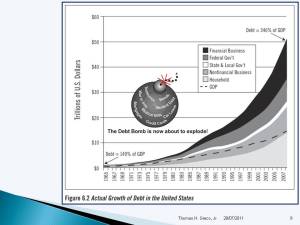

Gardner points out that there is good reason to celebrate the “bad” economic news being reported in the media. Hopefully, his upcoming film will include something about compound interest and the debt-money system that has been driving endless growth of production and consumption. Debt growth must cease if we are to make a smooth transition.-t.h.g.

Good News: Economic Recovery Stalls!

Posted By Dave Gardner On August 3, 2011

by Dave Gardner, director of the upcoming documentary GrowthBusters

Economic news last Friday was quite positive. Annualized U.S. GDP growth was less than one percent in the first half of 2011.

However, I would hazard a guess that, oh, some 99.9 percent of the world considered this bad news. It was characterized in the New York Times [1] as a “snail’s pace.” Journalists and commentators around the world are predictably typing out words like weak, anemic, malaise, gloomy, bleak, doldrums and stagnation.

So why would I celebrate? Do I get perverse, morbid pleasure at seeing my fellow humans unemployed, upside down in their mortgages, or dining at soup kitchens? I do not. The fallout of the recession is real, it’s painful, and it’s sad. But steady or declining GDP is not bad news. Nor is the drop in consumer spending [2] reported Tuesday.

While many impacts of the recession are tragic, these are the pains of adjusting to a new reality: the end of growth. They are a necessary part of a temporary phase. We might call it the cocoon phase, as we metamorphose into something more beautiful.

Consider these headlines from the past two years. Are they good news or bad?

- Recession Puts Babies on Hold

- Tiny House Movement Thrives Amid Real Estate Bust

- Home Production Falls as Economy Languishes

- Global Coal Use Stagnates Despite Growing Chinese and Indian Markets

- Total Municipal Waste Generation Dropped

- Home Depot Calls a Halt to Rapid Expansion

- European Union Carbon Pollution Drops

- GM to Close Hummer

- Gasoline Spike Fuels Surge in U.S. Bicycle Sales

- Bottled Water Consumption Growth Slows

- 30-Year Growth Spurt Ends for Average American House Size

- Ad Spending Down

- Airlines Ground More Than 11% of Their Jets

- Breast Implants are Deflating Along With the Economy

- More Than 400 Meetings in Las Vegas Recently Cancelled

- 2nd Home Market Declined 30%

Looking at these headlines through an archaic lens, last century’s worldview that growth is the Holy Grail, these stories seemed like bad news. But through a more modern, 21st century lens that values true sustainability, they herald a world slowing down toward a responsible level of human activity.

Think about it. Smaller houses mean less deforestation, less habitat converted to subdivisions, less concrete (production of which emits significant CO2), and less living space to heat or cool (again reducing CO2 emissions). Less coal use is also good news in the greenhouse gas department — as are grounded jets, no more Hummers and a switch to bicycles. Strangely we see no signs that politicians, pundits or journalists are thinking this deeply about the subjects.

I’m not the first to recognize this recession as an opportunity. Great minds like Gus Speth and David Korten are doing their best to turn this recession into a course correction. Korten’s Why This Crisis May Be Our Best Chance to Build a New Economy [3], and Speth’s Towards a New Economy and a New Politics [4] are good examples of this. Even Jay Leno got into the act, congratulating President George W. Bush in 2008 for doing more to fight climate change than Al Gore — by slowing the economy. Of course the impacts of economic growth reach far beyond the climate. Our increasing economic activity is causing habitat destruction, species extinction and pollution [5]; and it is liquidating critical resources like fertile soil.

I’m aware of no journalist who sought out Speth, Korten, Daly, Czech, Victor or Heinberg for an alternative view on Friday’s news. A story about ice melting would include comments from both real climate scientists and climate change deniers. But for this GDP story there was no discussion in the newsrooms about getting the other side — a quote about how terrific it is that gross domestic product may be settling toward a steady state. They assume GDP growth is good news and economic contraction is bad news — for everyone. It doesn’t even occur to them to question that assumption. Blind faith in the old worldview still has a tight grip on the reporters and editors. This needs to change.

I look forward to seeing the butterfly!

–

Dave Gardner is the filmmaker behind the documentary, GrowthBusters, which premieres in late October. The nonprofit film’s final fundraising campaign on Kickstarter [6] is in its last week. For more information about the film or to organize a screening, visit www.growthbusters.org [7]. Dave can be reached at dave@growthbusters.org [8].