A credit clearing system is an arrangement in which the members of an association of traders, each of whom is both a buyer and a seller, agree to allocate to one another sufficient credit to facilitate their transactions amongst themselves. That means they simply keep a record of their purchases, sales, and account balances, allowing some members to buy before they sell. In the long run, each member is expected to earn (from their sales) as much as they spend (on their purchases).

When a members buys something from another member, the price is subtracted (debited) from the account of the buyer and added (credited) to the account of the seller. Thus, members’ balances will fluctuate over time, being sometimes negative (in debit) and sometimes positive (in credit).

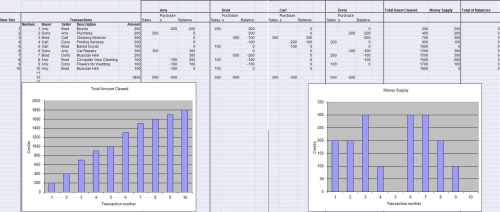

In such a system, the total amount of credit outstanding at any point in time can be thought of as the money supply within the system. That will be the sum of either the positive balances or the sum of the negative balances. These two sums of course must always be equal to one another, the total of all account credits must always be equal to the total of all account debits.

Here below is a table that describes the credit clearing process. Note how the money supply fluctuates up and down as credit balances are spent and debit (negative) balances are reduced when sales are made by those who previously had a debit balance.

Credit clearing is the highest stage in the evolution of reciprocal exchange, which, in effect, makes money as we’ve known it obsolete. The fact is that goods and services pay for other goods and services, whether we use money as an intermediate payment medium or not. Direct credit clearing makes the use any third party credit instrument, like conventional money, unnecessary.

What does this mean for the quantity theory of money? We should stop thinking of money as a thing, the quantity of which is all important and controlled by some outside authority like a government or central bank. Instead, we see that money can be thought of as simply a system of accounting for credit in which the quantity can fluctuate according to the needs of traders to exchange value with one another, and the quantity of credit allowed is determined only by the amount of valuable goods and services available to be traded.

The fact is that present day banking is mainly a credit clearing process in which additions and subtractions are made to bank customers’ account balances. However, banks perpetuate the myth that money is a “thing” to be lent. If a client’s balance is allowed to be negative, the bank considers that to be a “loan” and will charge “interest” on it. Has the bank loaned anything? Not really. What they have done is to allocate some of our collective credit to the “borrower.” For this they claim the right to charge interest.

It is clear from the example below that any group of traders can organize to allocate their own collective credit among themselves interest-free. Done on a large enough scale that includes a sufficiently broad range of goods and services spanning all levels of the supply chain from retail, to wholesale, to manufacturing, to basic commodities, as well as employees, such systems can avoid the dysfunctions inherent in conventional money and banking and open the way to more harmonious and mutually beneficial trading relationships.

The credit clearing process can be applied at any economic level from trading amongst individuals, to business-to-business exchanges within a regional or national economy, to international trade amongst member nations of a trading union.

By providing the associated members with a “home-grown” source of interest-free liquidity (means of payment), credit clearing exchanges reduce their members’ need for bank borrowing and provide a large measure of independence from national currencies and international financial institutions while at the same time encouraging domestic sourcing and production instead of reliance upon imports.

t.h.g. August 6, 2007. Revised July 22, 2016.

Pingback: The Final Chapter for Dollar Dominance and the Unipolar World Order | Beyond Money

This idea of each vendor and individual issuing their own credits, that can circulate and be redeemed for their goods and services, certainly seems very decentralized and empowering!

I would like to learn more about how the *exchange rates* on the credit clearing exchanges are calculated. Would it be possible to implement these credit clearing exchanges entirely on-chain, as is done with UniSwap for example (liquidity pools between any two assets)? My main question mark is about price discovery. It seems to depend on external factors such as how many credits have been sold by the vendor, their current ability to redeem the credits, and the quality of their goods / services and demand for them. These are subjective things, and I suppose there would be an order book between every two pairs? And we need a third party ledger to somehow keep track of all the issued credits (like blockchain-based currencies do, or credit bureaus have done for decades).

The other question is, what can vendors “buy” with their credits they’re putting up for sale, when they issue them before they’re redeemed? They would buy other credits in the community, which were also put up for sale? Or they can sell them for some sort of currency with a wide network effect already, like federal dollars or local coins? It seems to me that these coins would likely become a unit of account in the credit clearing exchanges, which would then make the system similar to the current one, with a money supply as a “thing” that constrains how much credit someone can issue after all…

LikeLike

Pingback: How to Fix Money, Banking, and the Economy, and Usher in a New Convivial Civilization – Expert Click

Pingback: How to Fix Money, Banking, and the Economy, and Usher in a New Convivial Civilization | Beyond Money

Debit credit cearing

LikeLike

Pingback: Community Currencies — Questions and Answers | Beyond Money

Pingback: 2020 May Newsletter | Beyond Money

Thank you for your response. Your reference articles were very informative.

I am thinking of starting a mutual credit clearing exchange in Berlin and am going thru the CES (tim Jenkins) network to use as a template for trading. Are there any other templates u recommend that might be better in terms of automation, design, more user friendly for traders and administrators, etc..?

Also, still trying to wrap my head around:

savings/investment – isn’t the very idea of saving credits paradoxical and kinda like hoarding (though not interest-bearing) since the idea is to keep trading?

would transferring a user’s excess credit to use at a later date turn off users who might want to spend it but don’t know how yet?

Can credit and debit limits be non-uniform (i.e. +200 to -50) and then adjust it as their trading history is built? It could help to at least let beginners issue a small amount before admin knows what their potential as ‘successful’ sellers is.

Lastly, would the stipulation that new users have to sell (a certain amount?) before they can buy ( issue credit) turn them off before they even get started?

Thank you so much and look forward to hearing from you.

LikeLike

Albert, answers to your questions:

1. “Are there any other templates u recommend…”

There are numerous platforms for credit clearing, most of them proprietary, but I am not in a position to evaluate or recommend any of them. I can just tell you what I know is available. You will need to decide which, if any, meet your requirements. Cyclos 3.0 is the only established open source platform that I know of. Sardex used it to bef=gin with but I think they may have upgraded to Cyclos 4.0 which is not open course, but I’ve heard that Cyclos 4.0 may be offered free to non-profits.

2. “savings/investment – isn’t the very idea of saving credits paradoxical …”

Yes, trade credits in a credit clearing exchange are intended to serve only as an exchange medium, not as a savings medium but the practical problem remains of what to do about excessive accumulations (credit balances) in a trader’s account. Some have suggested imposition of a penalty on positive balances (called “demurrage”) but that is counterproductive. First of all is the question of how it will affect member satisfaction. I can’t imagine it will be welcomed. Secondly, it seems like a penalty on the members who have been most productive and have put large amounts of value into your network. Would you really want to discourage them from selling more?

In commercial “barter” exchanges, the usual practice is to provide brokering assistance to help members with positive balances find purchasing opportunities. In my experience, the accumulation of large positive balances is usually the result of excessive credit lines to other members. If that is the case, the remedy lies in adjusting those credit lines downward.

Yes, we want to discourage the use of trade credits as a savings medium, but some people will inevitably have surpluses in their trading account. The answer in conventional finance has always been to have saving accounts separate from trading accounts.

In my book, Money: Understanding and Creating Alternatives to Legal Tender (2001) I proposed that members with excessive positive balances be encouraged to lend or invest them privately to other members on negotiated terms. If, after a certain length of time a balance remains excessive, it could be automatically transferred to that member’s savings account, then the admin would lend or invest those credits on their behalf. Saving is a way of converting present surplus to something that will satisfy future needs. It needs to be addresses sooner or later.

3. “Can credit and debit limits be non-uniform (i.e. +200 to -50) and then adjust it as their trading history is built? It could help to at least let beginners issue a small amount before admin knows what their potential as ‘successful’ sellers is.”

a. The credit limit on an account need not be the same as the debit limit on that account although it does make sense to make them equal to keep a healthy velocity of credit circulation.

b. To let “beginners” issue even a small amount can be problematic if there are a lot of them and only a few members that are established business that have demonstrated capacity to sell goods or services that are in everyday demand. You need to build on a solid foundation of members that are ready, willing, and able, to sell, day to day, things that people want and need. Without that, you will end up like scores of other failed exchanges in which credits accumulate in the hands of the few sellers that offer the most popular items then find little of value to spend them on. This has been demonstrated time and again.

4. “Lastly, would the stipulation that new users have to sell (a certain amount?) before they can buy ( issue credit) turn them off before they even get started?”

Ask them. But what does it matter? It’s committed sellers of real value you want.

s MUST

LikeLike

Greetings sir. Couple of questions:

Is it possible for LETS exchanges to handle big “dollar” items like purchasing a car, a house, a business enterprise?

Aside from preferred issuers, what credit/debit limits should regular folks be allowed?…. or are they tailored to each person?

Thanks

LikeLike

LETS systems are typically comprised of individuals offering sideline services. The relevant questions is “can trade exchanges the provide moneyless trading opportunities by using the credit clearing process handle big dollar items?”

The answer is yes, and they do, in the commercial trade exchanges that abound throughout the world. The members of these exchanges are established businesses that have goods and services regularly available for sale. The credits in such exchanges are short-term, provided only to clear goods and services that are in the market.

Now, if you mean can an individual use trade credits to buy a car, the answer is generally “no,” unless that individual is an active seller of enough goods and services to offset his debit in a short period of time, say two or three months. If that is not the case, then such a transaction falls under the rubric of “consumer credit,” which must be financed through the reallocation of existing money provided by savers, or, in a credit clearing exchange, through the reallocation of surplus credits from members who wish to save them to spend later.

LETS, like any credit clearing exchange, facilitates exchange of existing goods and services; it is not intended to provide long term financing for consumers or for capital formation, but as these exchanges develop, such functions can be added, like savings and loan associations were added alongside commercial banks.

LikeLike

Regarding your second question, the credit/debit limits on each account need to be set in proportion to the volume of sales through each account. This is the process of monetizing the value of goods and services that the particular member is ready to provide to the other members of the exchange. It is not a judgement about anyone’s values as a human being.

“Regular folks” can be allowed as members, but unless they are active sellers, they would need to earn credits before they could spend. As they become active sellers, then they can qualify for a line of credit based on their sales volume.

LikeLike

See my article at https://ijccr.files.wordpress.com/2013/04/ijccr-2013-greco.pdf

LikeLike

There are numerous videos available that describe how credit clearing works in the scores of actual trade exchanges that are operating around the world. The Open Credit Network is an emerging cooperative and open source platform is described in this video: https://youtu.be/AUWuV7gFzkA.

LikeLike

Pingback: Currency Synergy Pt. 1 — GETS, Collaborative Consumption | GIFT OF BEING : ECONOMY IN RESONANCE

Pingback: Vectorance Prose — The Abstract Energetics of a Universal Exchange | Gift of BEing : Economy in Resonance

Pingback: Policy-Level Ideas | Money by Debt

Crom Alternative Money – a rare and concrete global solution which offering multi-currencies alternative payment system.

Crom is based on the concept that the value of money is created not by the one who issues the symbols but by the one who accepts them.

Free from usury, our objectives are quite opposite of debt-based money system consequences.

LikeLike