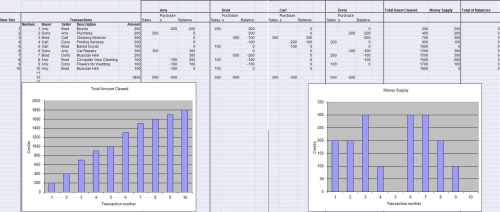

Here is a table that describes the credit clearing process. Click on the image to download the full sized file.

Credit clearing is the highest stage in the evolution of reciprocal exchange, which, in effect, makes money as we’ve known it obsolete. The fact is that goods and services pay for other goods and services, whether we use money as an intermediate payment medium or not. Direct credit clearing makes the use any third party credit instrument (money) unnecessary.

A credit clearing system is an arrangement in which a group of traders, each of whom is both a buyer and a seller, agree to allocate to one another sufficient credit to facilitate their transactions among one another. The rest is merely bookkeeping.

In such a system, the total amount of credit outstanding at any point in time can be thought of as the money supply within the system. That will be the sum of either the positive balances or the sum of the negative balances. These two sums of course must always be equal to one another. Note how the money supply fluctuates up and down as credit balances are spent and debit (negative) balances are reduced when sales are made by those who had a debit balance.

What does this mean for the quantity theory of money?

The fact is that present day banking is mainly a credit clearing process in which additions and subtractions are made to their customers’ account balances. However, banks perpetuate the myth that money is a “thing” to be lent. If a client’s balance is allowed to be negative, the bank considers that to be a “loan” and will charge “interest” on it. Has the bank loaned anything? Not really. What they have done is to allocate some of our collective credit to the “borrower.” For this they claim the right to charge interest.

It is clear from the example below that any group of traders can organize to allocate their own collective credit among themselves interest-free. Done on a large enough scale that includes a sufficiently broad range of goods and services spanning all levels of the supply chain from retail, to wholesale, to manufacturing, to basic commodities, such systems can avoid the dysfunctions inherent in conventional money and banking and open the way to more harmonious and mutually beneficial trading relationships.

t.h.g. August 6, 2007

I do understand the artificiality of charging interest for lending money. However, in a credit clearing system what is the incentive for lenders (debitors) to repay debt? Asked differently: What are the laws or mechanisms behind the system guarantee its functioning?

LikeLike

A participant in a credit clearing system is required to reciprocate by selling to others in the system, in other words, to redeem his debits. The usual guarantees can be used to assure that. The greatest incentive, however, is the desire to continue to have the privilege of cashless trading within the system.

LikeLike

Tom, i would enjoy seeing your response to a question regarding community currency posted by Greg Mankiw on his blog: http://gregmankiw.blogspot.com/2007/06/berkshares.html

LikeLike